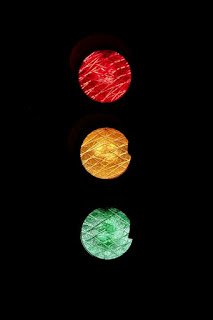

Over 80 Percent Of You Need To Read This

Did you know that an estimated eighty percent of people in the country today are in debt? Over seventy percent will die in it with amounts owed exceeding sixty thousand. You can read more about that on marketwatch.com. Those are some crazy statistics, and it means that the advice we’re going to offer shouldn’t fall on deaf ears. Instead, you should use it to your advantage, ensuring that if you are in debt, you can handle the situation effectively. We think that the situations that you’re in can be summed up with three distinct categories.

Green

People in the amber group are overspending and living past their means. They are probably borrowing more than they should be to pay for luxuries but are definitely not in a dire situation. Instead, the issue is just building without them really realizing. Right now, they can still complete a course correction with minimum effort. If you’re in this situation, all you need to do is pay off any debt that you already owe and then make sure you’re living on a budget. That way, you’ll be able to make sure you can avoid borrowing too much in the future which is exactly what you want.

The green group are in debt, but they typically have good enough jobs that they can manage it easily enough. However, they are certainly not in a position to handle an issue like a redundancy, and that can plunge them into amber alert.

Amber

If you’re in Amber, the debt has already built to a level that you can handle. This might be due to the fact that you have lost your job or you are living on a lower income. Single parents often find themselves in amber because providing for kids is far more difficult without the benefits of an extra paycheck. Amber actually happens to the best of us, and we don’t always see it coming. When you’re in this position, your best option is to look for a debt relief program. Various companies and organizations offer debt relief, and you can compare options on debtreliefprogram.co. There you’ll also find helpful advice and handy tips to avoid debt. This is going to help you manage your debt and get out. You’ve got a long road ahead, but you will survive and bounce back. It just takes a little hard work.

The problem here is that most people in amber don’t recognize or don’t want to admit that they have a problem. Avoiding the issue is the worst thing you can do in this situation.

Red

If you’ve reached red, you might not be able to recover from your debt, even with assistance. It’s at this point, you need to think about selling your assets to pay off what you can and then filing for bankruptcy. With legal help, you can avoid debt destroying your life, although it will seem like it at the time. Don’t worry, you can get through this, and the hardest part about reaching red is that it puts you back to square one. However, if you think positively this can be seen as a fantastic opportunity to start again and do things right. That way, you can join the twenty percent of people who aren’t kept up at night thinking about money.